The county is entirely within the Pine Ridge Indian Reservation and contains part of Badlands National Park. It is an alcohol prohibition or dry county; taxes on alcohol consumed within the county go to other counties.

Oglala Lakota County is one of two counties in South Dakota that does not have its own county seat (Todd County is the other). Hot Springs in neighboring Fall River County serves as its administrative center. It is also one of five South Dakota counties that are entirely on an Indian reservation. (The others are Corson, Dewey, Todd, and Ziebach.) [Article: Why Does a Reservation County also have a County Government?]

Oglala Lakota County was renamed in May of 2015, originally it had been named Shannon County. Until 1982 Oglala Lakota and Washabaugh County, South Dakota, were the last unorganized counties in the United States. Although it was organized and received a home rule charter that year, Oglala Lakota County, as noted above, contracts with Fall River County for its Auditor, Treasurer, Director of Equalization, State’s Attorney and Registrar of Deeds.

Courthouse Closed – 4th Of July

Fall River & Oglala Lakota County Courthouse in Hot Springs will be closed on Friday, July 4th, 2025 in observance of the 4th of July holiday. Normal hours of 8am – 5pm will resume Monday, July 7th, 2025.

Courthouse Closed – Memorial Day

The Fall River & Oglala Lakota County Courthouse in Hot Springs will be closed Monday, May 26th, in observance of Memorial Day. Regular office hours will resume Tuesday, May 27th.

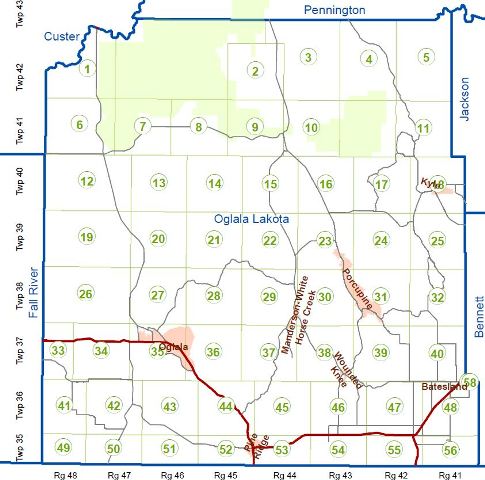

Updated Map Book

The Oglala Lakota landowner map book has been updated for 2025. See the map book webpage for a clickable overview map. Pages can be viewed, printed, or downloaded. page 1 | page 2 | page 3 | page 4 | page 5 | page 6 | page 7 | page 8 | page 9 | […]

Elderly & Disabled Tax Freeze Applications Due April 1, 2025

Deadline for the Elderly & Disabled Tax Freeze is April 1st. This program prevents the homeowner’s property from increasing in value, for tax purposes. This means that as the value of the home increases, the homeowner will pay tax on the former (lower) value. Property is defined as the house, garage, and the lot upon […]