The NWS Weather Forecast Office in Rapid City is making some changes to the Public Weather Forecast zones in our area. The purpose of these changes is to provide more accurate headlines for winter and non-precipitation hazards. These changes will go into effect September 19th. See NWS article for more information: https://www.weather.gov/unr/Public_Zone_Change2023

Weather Forecast Zone Changes

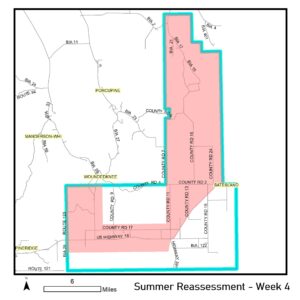

Reassessment – Week 4

The assessors are back in the field this week after some interruptions due to weather and classes. The week of August 20th the assessors will be out on Tuesday and Thursday working routes west and north of Batesland.

See Summer Reassessment page for additional maps and frequently asked questions.

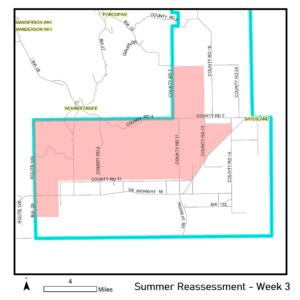

Reassessment – Week 3

The assessors are back in the field this week after some interruptions due to weather and classes. The week of July 17th the assessors will be out on Tuesday working routes west of Batesland.

The assessors will not be in the field for the next two weeks due to meetings and training. They will be back to finish reassessment in Oglala Lakota County in August.

See Summer Reassessment page for additional maps and frequently asked questions.

Reassessment – Week 2

For the Week of June 26th the assessors will be staying in office so they are not tearing up the rain soaked roads. They will be back out next week if the weather drys up.